BUILD Uses Entrepreneurship to Teach Financial Literacy to Teens

How will you celebrate financial literacy month? Here are 3 ways BUILD brings financial literacy education to our students:

1. BUILD Gives Students Bank Accounts!

Throughout BUILD, students have bank accounts in which their business funds are kept, and they are provided with debit/credit cards and checkbooks to access these funds for business-related purchases. Though finances are overseen by teachers and BUILD staff, students are responsible for ensuring that their accounts are reconciled properly.

2. Putting Theory into Practice!

Through various selling events, students learn how to responsibly track sales. They also manage withdrawals from and deposits to their bank accounts. As they begin to operate their businesses more independently in their sophomore year and into their junior year, students continue maintaining their business ledgers, reading bank statements, completing reconciliation paperwork on a monthly basis. With this information, students may have to adjust their financial strategies based on actual sales.

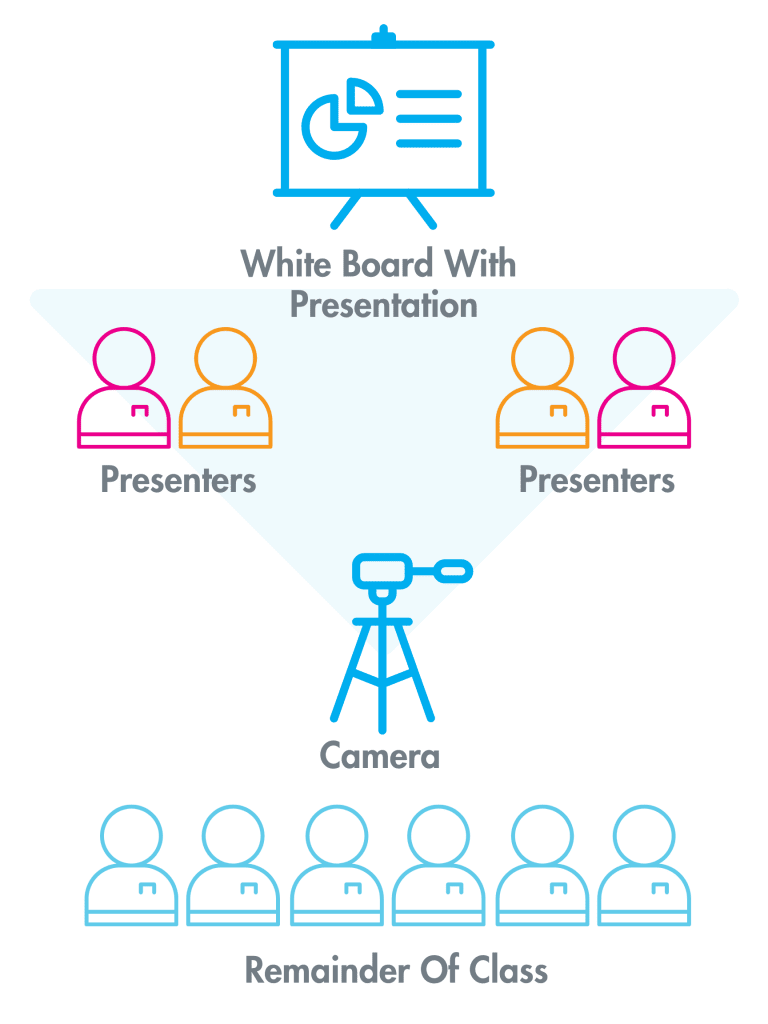

3. Working with Venture Capitalists!

After refining their business plans, sophomores pitch their business ideas for up to $1,000 in funding per team so that they can operate their businesses for the next year and a half. The winning students then receive guidance from their VCAs about utilizing this funding to achieve their desired goals.